Download 7 Steps to Eliminate Your Debt and Be a Ventriloquist for Fun or Profit (Sense and Money) - Dan Williams file in ePub

Related searches:

5 Steps to Eliminate Credit Card Debt Once and for All

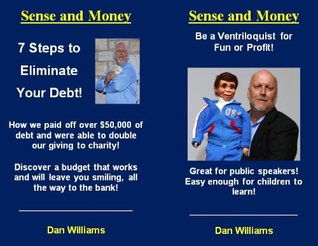

7 Steps to Eliminate Your Debt and Be a Ventriloquist for Fun or Profit (Sense and Money)

7 steps to get rid of your financial stress once and for all - USA Today

10 Steps and Strategies to Getting Out of Debt in Less Than a

Review and Reduce Your Debt Basic Steps Smart About Money

Follow These Steps to Debt Elimination and Get on the Path to

Pay Off Debt in 7 Steps and Still Maintain Your Lifestyle

How to Get Out of Debt Fast 23 Tips and Tools

Getting out of debt - tips and help with debt problems Uswitch

How to get out of debt in 2021: Seven tips for a brighter financial

How To Budget Money: Eliminate Your Debt And Start Saving

Best Tips for How to Get Out of Debt Fast - GoFundMe

Picking up extra time at work, getting a second job or selling some items can help you to eliminate your debt much more quickly. Setting mini-goals and allowing yourself small celebrations (like dinner out) when you achieve a goal (such as paying off $5,000 in debt) can also help you stay focused.

The more money you put toward your debt, the faster you can pay off your debt for good. If you don’t already have one, create a monthly budget to better manage your money. Seeing all your expenses detailed in a budget can also help you figure out how you could cut out some expenses and use that money for your debt.

The debt snowball method of debt reduction is just one of ramsey’s famous “7 baby steps” to living debt-free, and living the life you want. We asked indiana university professor kristoph kleiner, an assistant professor of finance at iu’s renowned kelley school of business, to help us evaluate ramsey’s baby steps.

Essentially, i followed all the steps you mentioned (took a hard look at my total debt, got a higher ($7k more) paying job, transferred balances to a 0% card and paid off a load of consumer debt. I’m scheduled to pay off all my consumer debt by april 2011.

7 steps to reduce business debt in 90 days they managed to eliminate all the credit cards with interest rate of 10 percent or greater and increase their cash flow.

The dti ratio is calculated by adding up your current monthly debt payments and dividing them by your monthly gross income. Let’s say you have a $300 student loan payment, a $500 auto loan.

Saving money on a tight budget is not only possible, it's imperative. One unexpected expense can have a huge impact when money is tight.

Begin organising your finances with our seven steps to getting out of debt.

Whether the debt is a home loan, car loan, credit card or some other debt, getting the lowest possible interest rate will help speed up the time it takes to eliminate your debt.

En español when getting out of debt is a priority, there are several things you can do to eliminate that debt entirely — or at least pay off most of it — in 12 months or less. Here are 10 tips and strategies to get you started on a debt.

23 feb 2021 you can pay your debts off faster and save thousands in interest charges. Getting rid of debt doesn't happen overnight, and it's easy to lose.

If your new year's resolution is to eliminate debt, men's health has some tips you must know.

At the end of a successful bankruptcy, the court will issue an order discharging your qualifying debts.

Find helpful customer reviews and review ratings for your money workbook: 7 steps to eliminate debt (sense and money) (volume 2) at amazon.

6 oct 2020 the first step is to stop using your credit cards altogether.

For more than 25 years, dave ramsey has taught people a step-by-step approach to slashing their debt called the 7 baby steps. On baby step 1, you save $1,000 in a starter emergency fund, and on baby step 2, you pay off all your debt (except the house) using a method called the debt snowball.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabl.

7 steps to pay off debt in retirement more if you already have a budget in place, look for ways to start putting money toward paying off one of your debts each month.

The aim is to track and then reduce or get rid of the things that are poisoning your bank balance.

Debt can sneak up on you and, before you know it, you're overextended with medical bills, student loans and credit card balances. You might consider debt consolidation, but this is an important decision.

Achieving financial fitness requires discipline eliminate high-interest debt and to accelerate the best part of the 7 steps.

Paying off large chunks of debt can feel like trying to summit a snowy peak in sandals. The average american household is saddled with over $137,000 of debt, according to usa today, making the journey to better, debt-free living especially daunting.

19 mar 2021 the immediate concern most of us have is how much more debt we are accumulating and how we can simple steps to reduce your debt.

Your step-by-step process is really doable and must be effective. Thank you for sharing your steps, which i can use because i am paying off my debt less than $10,000.

26 mar 2021 debt consolidation programs work with your creditors to help reduce interest rates on debts and eliminate varying fees such as late fees, though.

1: make the minimum required debt payments on all of your outstanding debt -- this is absolutely vital to protecting your credit score.

At worst, you're drowning in debts and fighting off bill collectors.

Debt consolidation advisors and companies typically evaluate your high-interest debt and financial resources and develop a plan to cut the high interest rates and get you a lower monthly payment.

Unfortunately, the space between realizing your debt is out of control and actually getting out of debt can be wrought with hard work and heartache. No matter what kind of debt you’re in, paying it off can take years — or even decades — to get out of debt.

7 jan 2019 start the new year out right with the peace that comes with having an actual plan for your money.

If you're in a hole, the first step is to stop digging, and that's what you're going to do this second week.

Check with your state’s statute of limitations and always reach out for legal help if you’re worried about resetting the debt clock. Once you get started taking the necessary steps, you should see a positive result even if it isn’t the exact desired outcome.

If your credit score is good enough, one of the most helpful steps you can take is transferring your debt to a credit card with a zero percent interest introductory rate to stem your interest growth. “however, make sure you can pay off that card in full on time to avoid getting into more debt,” says diana of moneytips.

It's too tempting to spend money in the moment if you don't.

8 jan 2021 here's how to pay off debt in six different ways to reduce your credit burden. A mistake that can stay on your credit reports for seven years.

Follow these seven steps to take control of your finances and pay off your debt for good.

When you are swimming in debt, a debt consolidation program may sound like a dream come true. However, there are pitfalls to be aware of before signing on for one of these programs.

Once you calculate your total debt amount, compare it to your income. We hope you didn’t go put your head in the sand after listing out all your debts. It can seem overwhelming, but having a realistic view of your debt is essential to starting your journey.

Need to get your finances under control? seven simple action steps from the national foundation for credit counseling can help you become a more confident.

The organization will point you in the direction of free or low-cost credit counseling and debt management services in your area. Next, you might try to see if you can refinance at least some of your debt at a lower interest rate.

Step 7) pay off debt #2, then transfer all of the money you were paying each month to the second debt and apply it towards the third debt, along with its minimum. This means the third debt will be getting: the first debt's minimum, the second debt's minimum, its own minimum, plus the extra money you found in your money list.

A definitive guide to paying down your credit card debt once and for all it all started with a pair of gold jimmy choo sneakers. She didn't need them, but they were stunning and with the swipe of a card they were hers.

To help you manage and reduce your debt, we've put together some top tips to get you started.

The maximum interest deduction – $1 million currently – would be reduced $100,000 for each year with a 15% credit based upon $500,000 maximum mortgage debt becoming effective in 2020.

10 may 2017 your income dropped and now you can't pay your bills.

Medical debt is one of the easier types of debt to remove from your report because of the hippa privacy laws. You may be able to get 50% or more of your medical collections removed from your report simply by disputing them.

Before you can start tackling your debt, you have to know exactly how much you need to pay back.

Step 2: choose your “plan of attack” for paying off debt once you know exactly how much you owe, you’re ready to strategically attack your debt. To do this, you need to prioritize which of your debts you’re going to pay off first — whether it be your credit card, student loans, whatever — based on the interest rate.

After paying off over $50,000 of debt, dan and marlis williams put the plan they used into a simple and direct format called: 7 steps to eliminate your debt. This proven method is easy to understand and implement for any family, civic group, business or church wanting to put their finances back on track and break the bondage of being in debt.

Step 2: make minimum payments on all your debts except the smallest. Just like a snowball rolling down a mountainside starts at the top as a mere snowflake, your debt snowball will take some time to pick up speed.

Post Your Comments: